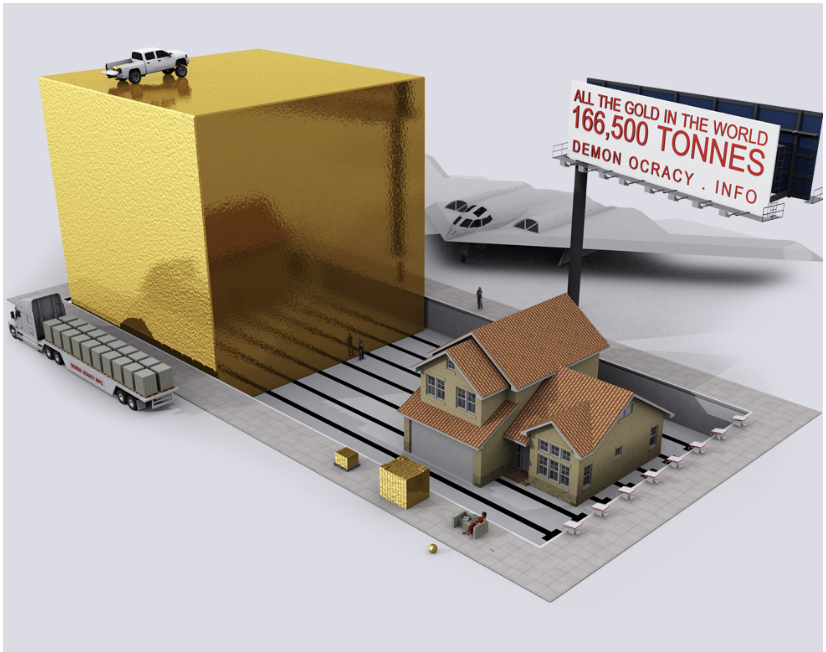

Famed value investor and the Oracle of Omaha, Warren Buffet told the crowd gathered at the Berkshire Hathaway Annual meeting recently that he “doesn’t see any utility in owning gold. It can’t produce things. If you take all the gold in the world… and put it into a cube, it would be about 67 feet on a side… but it’s not going to do anything for you.”

Photo courtesy of Visual Capitalist

Dave Ramsey, investing guru and CEO of Ramsey Solutions, says, “I don’t put money in precious metals at all, because they have a lousy long-term track record.”

Both men would produce evidence to substantiate their case. So, why even consider precious metals as an investment in the future? In a word, “Inflation.”

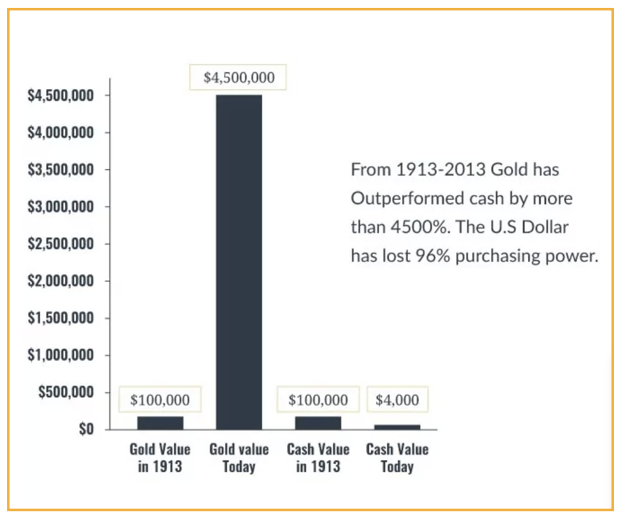

Since 1971, when president Richard Nixon effectively broke the tie between the US dollar and gold, the value of the dollar relative to gold has dropped dramatically. In 1971, it took $40 to buy 1 ounce of gold. Today, that very same shiny ounce of gold sells for $2300! “Wow,” you say. But did gold really go up that much?

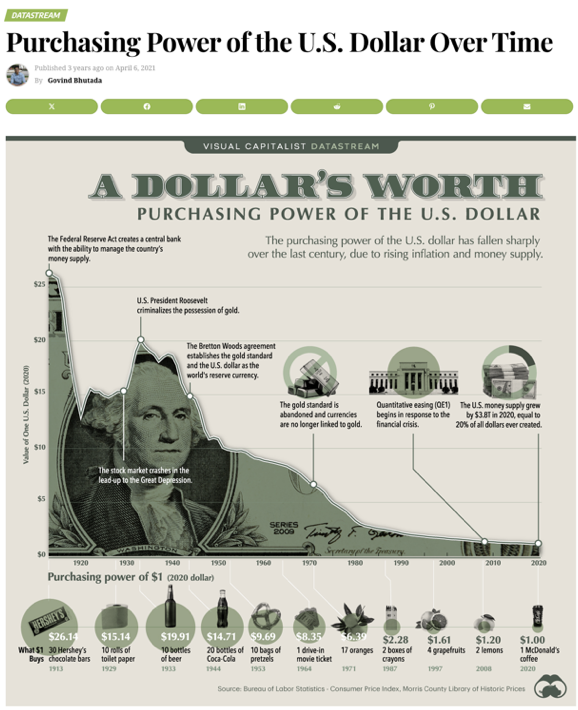

What actually happened was that the value of gold relative to the US dollar did increase, but it was only because the dollar won’t buy as much in 2024 as it did just a little over 50 years ago. We refer to the rising cost of things we buy with the dollar as ‘inflation’, when in actual truth what is happening is the dollar has been consistently weakening. It, therefor, takes more dollars to buy the same items we bought back in 1971.

Chart courtesy of Visual Capitalist

Here are a few examples. The cost of a new Ford Torino in 1971 was $3,895. Today an average cost paid for a new car is $47,244. Gasoline, back then was 36 cents a gallon, compared to $3.66 today. Ground beef was $0.64 in 1971, today it is $4.02 per pound.

If you were alive back then and had you known what prices were going to do, you may have considered buying some of these things and storing them away. That, however wouldn’t be too practical. The meat would be no good, and the gasoline would have gone stale (if not evaporated). If you would have driven that new 1971 Ford Torino home, parked it in the garage and covered it with a tarp, however, it would be worth quite a bit more than you paid for it in 1971. That storage, though, caused problems. The engine corroded, the tires suffered dry rot, the vinyl interior cracked due to constantly changing heat and humidity levels in your garage, and your wife constantly complained about the space it was taking up and the annual cost of the insurance policy you kept on it in case the garage burned down. That car you bought in 1971 cost you the equivalent of 97 ounces of 1971 gold. Today, in 2024, that 97 ounces of 1971 gold is worth $223,100. For 53 years you had about 6 pounds of gold tucked under the mattress. It sat there and did absolutely nothing. Warren Buffet was right because your little stack of gold didn’t produce any baby nuggets, nor did it pay any dividends. All it did was protect you against inflation.

Inflation is unlikely to disappear anytime soon. Since the COVID panic, the US Federal Reserve has increased the money supply (to meet the demands of Congress and the president for more giveaways) by $4.5 trillion.

In an effort to combat inflation, the Federal Reserve has increased interest rates on the money they lend to banks. The banks have passed these increases along. In 2021, a 30-year mortgage could be had for around 3%. That mortgage today hovers around 7% and is making housing less affordable in part because of those interest rates.

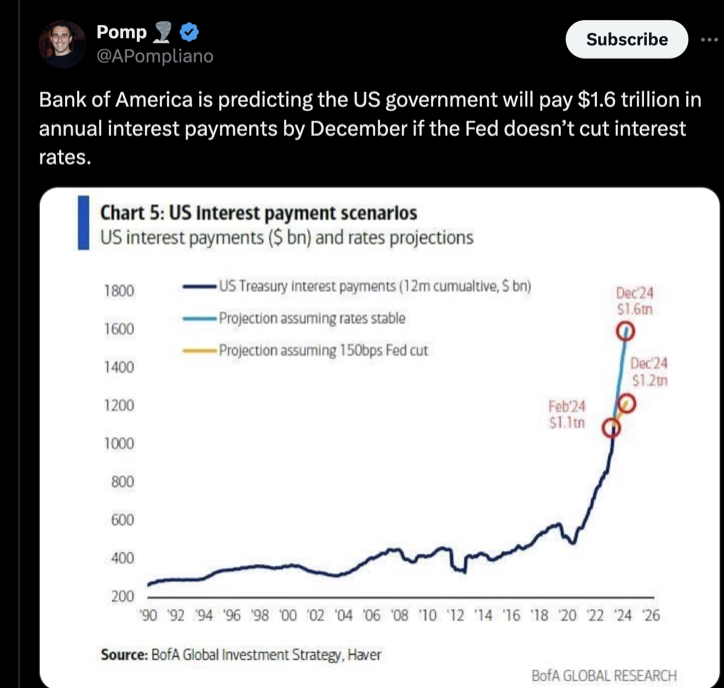

The US Government has to pay interest on the money it borrows as well, and right now the interest rate we pay on the national debt racks up another $1 trillion dollars in interest expense every 100 days!

Much of the debt sold by the Treasury Department is bought by the Federal Reserve. Where do they get the money to do that? By pushing a few buttons on a computer. Voila! Billions of new dollars are added to the money supply, further fueling inflation’s fire.

If you think inflation will not be a problem in the coming decades, do not buy gold. On the other hand, if you do step up to the counter and buy gold, you just might see Dave Ramsey in line too.

Welcome to 3-Minutes A Day University, where every day you can learn a little about a lot of things in three minutes or less. We help you expand your knowledge and understanding of the real world, and 3-MAD University is tuition-free. Our wide-ranging syllabus includes a fascinating insight into topics including Health and Medicine, Science, Sports, Geography, History, Culinary Arts, Finance and the Economy, Music and Entertainment, and dozens more. You will impress yourself, your friends, and your family with how easy it is to learn facts and perspectives about the world around you. One topic you will never find covered is politics. We hope you enjoyed the previous three minutes. If you liked this post, please pass it along to a friend.

Was this email forwarded to you? Subscribe Here.

© Copyright 2024. 3-Minutes A Day University All Rights Reserved. Unsubscribe